They’re not called Zuckerbucks, but Facebook just reinvented digital money. Facebook’s Libra cryptocurrency that will launch early next year is more like PayPal than Bitcoin — it’s designed to be easy enough for everyone to use. But it’s still complicated to understand, so I’m going to break it down for you nice and simple.

Watch our handy video above or read the transcript below.

Libra is like cash that lives inside your phone. How do you buy Facebook’s cryptocurrency? Starting in 2020, you’ll be able to purchase Libra through Libra wallet apps on your phone or from some local grocery and convenience stores. You cash in your local currency like dollars and get nearly the same number of Libra coins, which are represented by this wavy three-line emoji instead of the $ symbol. But first you’ll have to verify your identity with a photo.

You’ll then be able to spend your Libra while online shopping, or potentially pay for things like Ubers or your subscription for Spotify, since those companies have partnered with Facebook to make Libra popular. Since it’s almost free to digitally move Libra from one account to the other, you won’t have to pay high credit card processing fees that can add almost 4% to your total. And some Libra wallet apps and shops will give bonus discounts or free coins for signing up and paying with Libra.

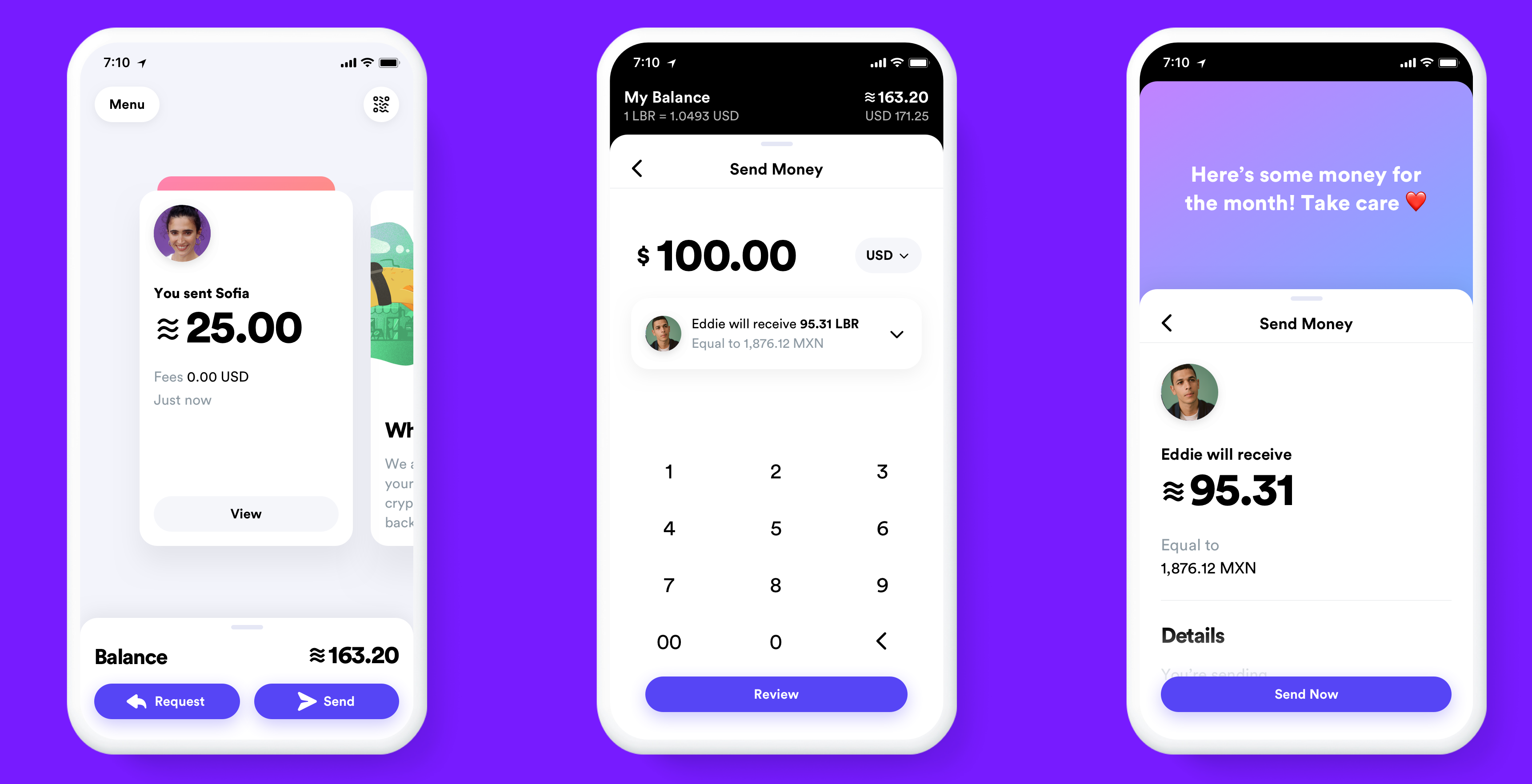

You’ll also be able to send and request money from friends like you would with Venmo or PayPal. It’s as easy to send Libra as it is a message. In fact, Facebook is building its own Libra wallet app called Calibra that will live inside of WhatsApp, Facebook Messenger and its own standalone app.

You won’t have to attach your real name and identity to any of your payments, but they will be public. Facebook knows it’s a little bit creepy and you probably don’t want it spying on what you buy. So Facebook set up a new company also called Calibra that will keep all your financial data separate from your Facebook profile. That means it can’t use your transaction data to target you with ads, re-order your News Feed or sell your info to marketers.

Eventually, Facebook hopes you’ll use Libra to pay your bills, scan your wallet’s QR code to purchase coffee or tap your phone to buy your public transit ticket. At any time, you can cash out of Libra and get your local currency back in your bank account, or handed to you at a local grocery store.

But how does the Libra cryptocurrency technically work…without a bunch of blockchain buzzwords? Libra is coded to have a stable price, be secure and be controlled not just by Facebook.

Instead, Libra is run by the 28-member Libra Association that it hopes will grow to 100 members by the time it launches in the first half of 2020. Financial companies like Visa and Mastercard, merchants and apps like eBay and Lyft, venture capital funds like Andreessen Horowitz and Union Square Ventures and nonprofits like Kiva are all members. They each paid at least $10 million to get one vote on the Libra council that controls what happens to the currency. They’ll be responsible for checking to make sure Libra transactions are real and creating the Libra Reserve.

Each time you cash in a dollar, that money goes into a big bank account called the Libra Reserve that creates and sends you roughly one Libra token. The Libra Reserve is made up of a collection of the most stable international currencies, like the U.S. dollar, British pound, the euro and the Japanese yen. The idea is that even if one of those currencies goes up or down in price, the value of the Libra will stay stable. That way, shops will accept the Libra as payment without worrying the value of the coin will drop tomorrow. Big swings in price are why older cryptocurrencies like Bitcoin or Ethereal haven’t grown popular as payment methods. Libra can also handle 1,000 transactions per second, while Bitcoin can only handle 7.

So how do Facebook and the other Libra Association members earn money? Off of interest on all the assets held in the Libra Reserve. After the Libra Association pays for its operations and investments in technology, members earns a cut of the remaining interest in proportion to how much they invested when they joined. If Libra gets popular, tons of people cash in and the reserve grows huge, the interest could add up to serious revenue for Facebook.

But there’s also a subtle second way Facebook could get rich from Libra. If the currency makes it easier for small businesses to accept payments online, they’ll sell more stuff. They’ll then have extra money to spend on Facebook ads, which will make it extra quick to buy things with Libra. Ninety million small businesses already have Facebook Pages, but Facebook only has 7 million advertisers. If it can turn more of those local merchants into ad buyers, Facebook’s revenues could skyrocket.

The big risk of Libra is that anyone will be able to develop apps for it. That could lead to another Cambridge Analytica situation. But instead of some shady app maker snatching your personal info, they could steal your digital currency. Facebook and the Libra Association say they won’t vet Libra developers, which leaves the door wide open to abuse. And if people get scammed, they’ll blame Facebook.

But if Facebook succeeds, the real win could be for the 1.7 billion people left in poverty with no bank account around the world. They’re exploited by international money sending services like Western Union or Monogram that charge steep 7% fees that take $50 billion away from families per year. And if they’re mugged, they could lose all their money since they have nothing stored online. All they’ll need is a photo ID and Libra could give them an alternative to a bank account that’s tougher to steal and could make it easy to pay for what they need.

There are plenty of reasons to worry that Libra could give Facebook and other tech giants more power or lead to people getting scammed. But it could also give disadvantaged people everywhere a way to join the modern economy. And at least it’s not called FaceCoin.

And if you want to know how Libra could spawn Facebook’s next scandal, read this:

Video by Gregory Manalo, b-roll via Libra Association